Do you want to create a business plan?

Why do I need a business plan?

The business plan provides a detailed guide for how your start-up will work. It also serves as the basis for applying for a business start-up loan. So if you need outside capital, a professional business plan is a must.

Is it difficult to write a business plan?

No, with the right guidance and good preparation, it is not difficult. You should definitely write it yourself and not just delegate it elsewhere. We provide you with a list of questions and business plan examples to guide you through the process.

What is the difference between a business model and a business plan?

The business model describes the basic principle of the business in a concise manner and is 1-2 pages long. The business plan provides a more detailed roadmap for starting a business and building it up in the future.

What is a financial plan?

A financial plan is a detailed part of the business plan where all the important financial aspects of your business are set out, analysed and planned. The financial plan puts your business planning on a firm footing and makes it easier to make the right financial decisions for your business.

What is a liquidity plan?

In a company, the liquidity plan is a part of financial planning and compares all of the inflows and outflows of cash expected within a defined planning period. It is like a bank statement for the future.

What is a site analysis?

The optimal location for each of your business operations can be selected systematically based on a range of different of factors. Factors affecting the choice of location include, for example, the catchment area, purchasing power, walk-in customers, parking facilities and accessibility, competition, the appeal of the location and rental prices.

What is a competitive analysis?

A competitive analysis compiles and assesses the business methods, behaviour, and products that competitors use to operate in your market. The goal of it is for you to find your place in the market and predict the behaviour of your main competitors.

Do I need a consultant to write my business plan?

This is not absolutely necessary. In fact, we generally recommend writing the business plan yourself because in the end, it is you who needs to understand your business and who will answer for it. When it comes to more detailed issues, however, it may be useful to work together with a consultant.

How to write a business plan using the start-up platform

Once you've carefully thought through and tested your business model, the next step is to write your business plan.

You need a business plan in order to get financing partners on board and to see how you can best build up your business.

Most people take far too long to turn their business idea into a bankable business plan. The reasons are almost always the same: they get bogged down in looking for the right model, spend too much time crafting a uniform plan based on various files and tables, and end up losing their bearings in the numbers section.

But it doesn’t have to be like that! On the start-up platform, you will find a recognised business plan tool that will help you write your business plan – both securely and free of charge.

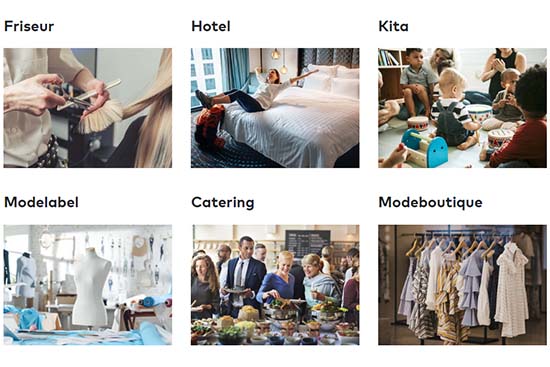

Whether you want to open a hair salon, launch a start-up, take over a company, or become self-employed to have a secondary source of income, our business plan tool can help with every start-up project, guiding you through the process step-by-step and linking the figures with each of the text-based sections to give you a practical simulation of your business.

Digital wizards make financial planning easier, key questions guide you through each chapter, and real-life business plans provide you with the right inspiration. You will find everything you need to write a good business plan on the start-up platform.

So there’s no need to search the internet any longer. Start writing your business plan and launch your business!

How to use the start-up platform

Many people setting up their own their own business dread writing the business plan because they don’t think they are up to the task. To make it less daunting, we have broken down the huge business plan package into a series of manageable portions. So you can just work your way from chapter to chapter. This way, you'll make quick progress and within a few days, will have a business plan that answers every question about your start-up.

Before we go into the contents of a business plan, we will introduce you to all the tools that will help you write your plan on the start-up platform.

Overview

As soon as you create a new business plan or open an existing business plan on the start-up platform, you will be shown all the different actions you can perform on your plan.

The overview acts as your business plan headquarters. From here, you can access all of the important functions.

As you can see, you can either continue working on the text-based part or the financial part, perform a quick check on key performance indicators (KPIs), or download a print-ready PDF file of your business plan.

In addition, you can also make use of the following set of functions:

Advisory services

Use this button to find out which organisations in your region can advise you on writing your business plan. You can contact them directly via the start-up platform to ask your questions.

Sharing with others

For those who are starting up as a team or would like to get feedback on their business plan, there is a function that allows the plan to be shared with others. This way, you can all work on a document from different locations and avoid the problem of working on multiple versions at the same time.

Preview

The preview shows you an overview of your business plan. It allows you to see which points you have already worked on and where your plan still has gaps.

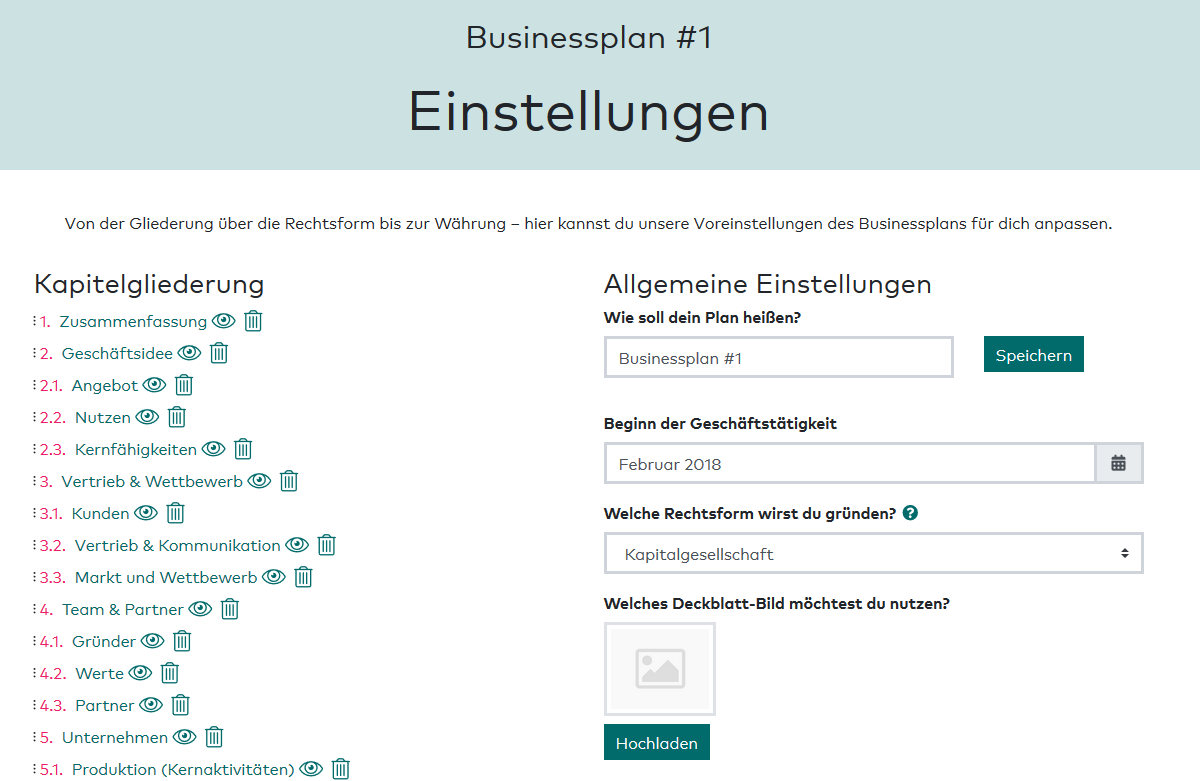

Settings

This button enables you to change the general settings (duration and title of your business plan, currency, legal form, etc.), rearrange the structure as you wish, and upload an image for the cover page of your business plan.

Structure

Every good business plan needs a clear and well-thought-out structure. The internet is packed with varying advice about how a business plan should be structured. So it’s no wonder that many new entrepreneurs are uncertain about what’s right for them: do I need a chapter with a ‘SWOT analysis’? What are the most important key performance indicators? Where do I put my marketing concept?

We have developed and coordinated the structure proposed in our business plan tool in cooperation with all of the important actors in start-up promotion in Germany. So if you use our tool, you can be sure that your business plan will be accepted by the key people later on. This way, you can simply concentrate on the content without ever losing the thread.

You can work through the structure from beginning to end or simply start with the sections that you find easiest – it’s is up to you.

The structure will be shown on the left-hand side every time you work on one of the chapters. This means that you always know where you are and can easily jump back and forth across your business plan. Alternatively, you can move directly from any chapter to the previous one or to the next.

You can customise the structure as you like under Settings (Einstellungen) in the overview. You can also add, hide, delete, rename, or change the order of chapters.

Key questions to guide you through your business plan

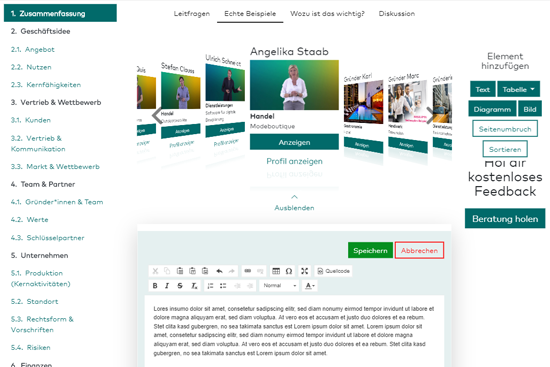

In each chapter, you will find several tabs offering a variety of different tools. You can find out how each of these works below.

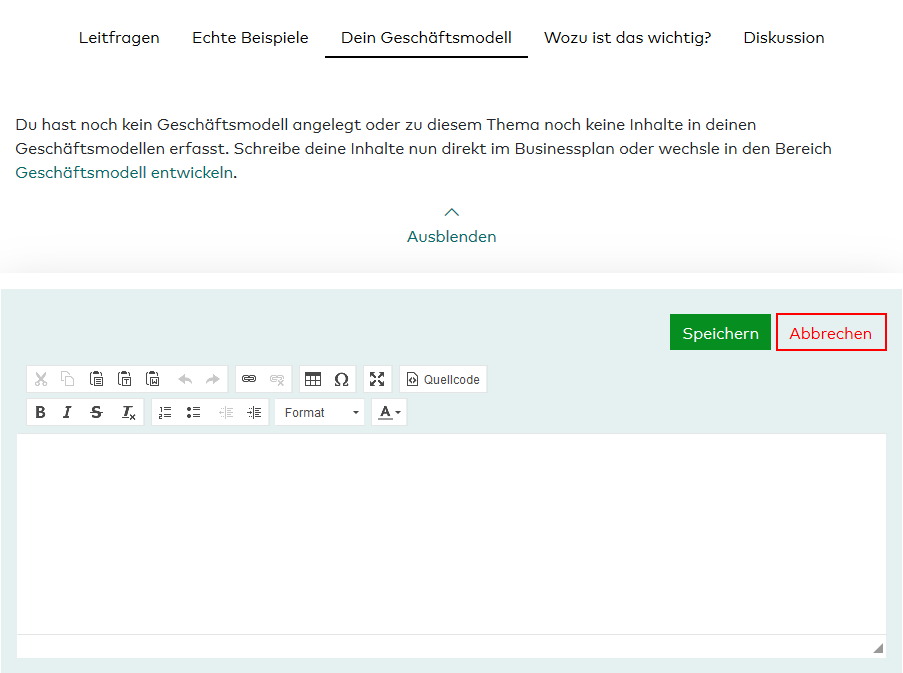

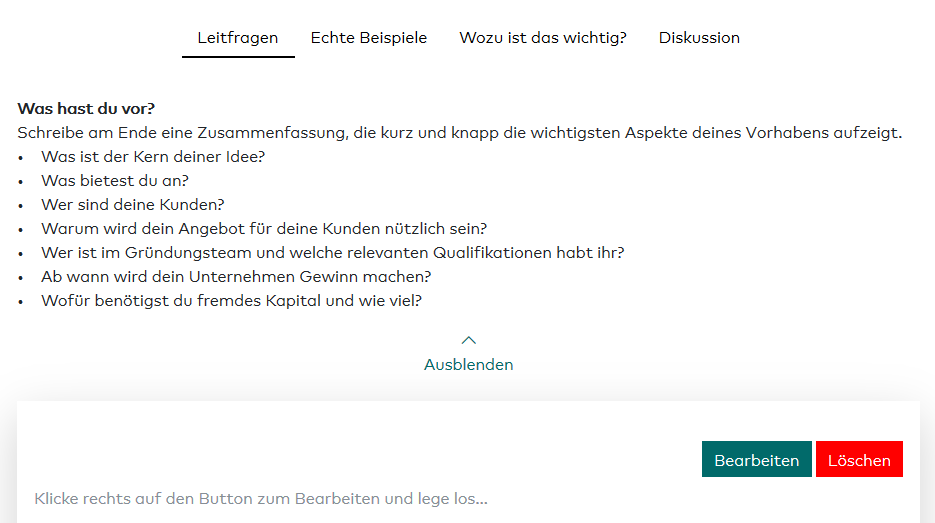

For each topic, we have set out simple key questions (Leitfragen). Your task is simply to answer these one by one. This will enable you to compile a complete business plan is piece by piece.

Simple key questions, such as these ones on sales and communication, will guide you through your business plan

Write your texts in the field below. Just click on Edit (Bearbeiten)and an input mask with a small formatting palette will open. As soon as you finish your work, click on Save (Speichern) so that nothing is lost.

We recommend that you create a separate text field for each sub-item in a chapter. This will enable you to stay flexible. You can change the order of the text fields and insert tables, diagrams or images later on. Add as many text-based sections as you like by using the green Text button under the Insert elements (Elemente einfügen) heading on the right.

Link to your business model

If you have already developed your business model using the start-up platform, some of the key questions will sound familiar. While your business model summarises the key aspects of your business as briefly as possible, your business plan allows you to go into more detail.

The Your business model tab (Dein Geschäftsmodell) shows you the thoughts you have already written down for the respective chapter. It is often enough to write these out in full and back them up with details in order to create your business plan. If you have designed a number of different business models, you can choose the appropriate one for the business plan you are working on.

Now the work of the last few weeks is paying off. The more you have gone through the various aspects your business model in advance, the easier it will be for you to turn it into a bankable business plan.

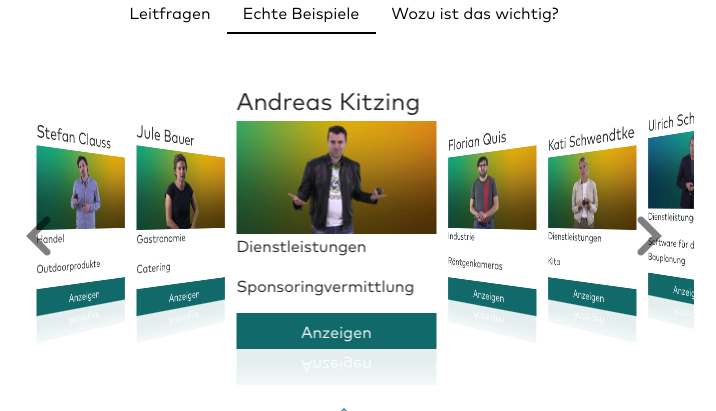

A blank sheet doesn't have to be daunting: learn from real-life examples

On the start-up platform, you will get the rare chance to read real-life business plans that have been actually been funded and implemented. If you get stuck, you can simply read what others have written on the same topic that you are working on. The Real examples tab (Echte Beispiele) shows you the corresponding chapters from the business plans of our featured entrepreneurs.

Their business plans might not be perfect in every respect, but they worked – and that's all that matters!

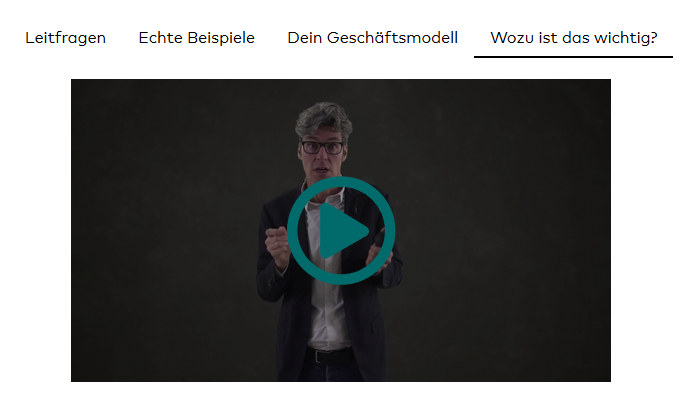

Why is this important? Expert videos with tips and explanations

It is not always immediately obvious what key aspects a particular chapter needs to cover. If you need more information, our short explanatory videos with start-up expert Dr Jan Evers will help you. In them, you'll learn what's important in each chapter and how best to go about writing your business plan.

Each video is assigned to an individual chapter.

Customisable design options

We make sure that your business plan is not only coherent in terms of content, but that it also has an appealing layout. So you don't have to worry about formatting all of your text, tables and diagrams. At the end, simply click on Download PDF (PDF herunterladen) and your plan will be saved as a print-ready document on your hard drive.

If you wish, you can customise the default layout in the settings: you can change the font, highlight text in different ways and add page breaks. This way, your business plan will be as individual as your start-up.

To make your business plan more descriptive, you have the option of adding images and diagrams across all of the sections. These can be uploaded directly from your hard drive and pasted into the text. In addition, charts and tables relating to the figures from your business plan are created automatically.

Whether it's a photo of your product, a floor plan of your shop, or a screenshot of your online shop – whenever a picture is worth a thousand words, you should make use of this feature.

You can change the order of the text-based sections, diagrams and images in a chapter at any point using the Sort function (Sortieren).

Digital wizards for financial planning

The financial section is rightly referred to as the heart of a business plan because it reveals plainly whether a business idea is economically viable or not. It is also the part that causes the most difficulties. This is why we've programmed several digital number wizards to help you put your financing on a solid footing.

The start-up platform’s digital wizards make financing simple.

The platform is already programmed with general values, such as the VAT rate or the amount of non-wage labour costs, so that you have a rough guide. If these numbers differ in your particular case, you can simply adjust the number wizards yourself.

Linking the text-based sections and the financial plan

A particular advantage of our business plan tool is that you can easily dovetail the text-based part with the financial plan. In each passage of text, you can insert the appropriate representation from the financial planning section via the Table (Tabelle) or Diagram menus.

The start-up platform’s business plan tool enables you to link up text and figures in a single click.

Here is one example of where this is beneficial: let's say you want to open a shoe shop. Like all start-ups, you expect your sales to increase over time. While you start out selling only five pairs of shoes a week, sales increase to an average of fifty pairs within the first six months. The rationale for this development is provided in the text-based section, where you describe in detail why you believe you can increase your sales. However, the corresponding figures are usually found later on, in the financial section. Inserting a diagram depicting your sales revenues enables you to clarify directly in the text-based section how the expected consumer behaviour of your target group will specifically affect your start-up.

The option to link the figures and text-based sections in a single click solves the typical problem of many start-up entrepreneurs who unintentionally write two independent business plans: a first describing their idea, target group and market, and a second with the numbers and tables. But the business plan only becomes a solid document when both of these sections come together.

Calculating figures for different scenarios

In order to assess the opportunities and especially the risks of a start-up, it is useful to develop and compare different scenarios. What happens if revenues do not develop as positively as expected? What if they are much higher? What if the prices for your product or service suddenly drop or raw materials become more expensive? What's the minimum amount of money you'd need to bring in to keep your shop afloat, and when would it be time to cut and run?

If you are able to provide a plausible answer to these questions, you will not only convince your investors and sponsors but, above all, you will establish an important basis for your own decision-making.

You can easily calculate the figures for several scenarios on the start-up platform by duplicating your business plan and adjusting the figures in the financial plan accordingly. You can do this via the My desktop (Mein Schreibtisch & Konto) button at the very top of the menu bar, which enables you to access all your business plans and business models.

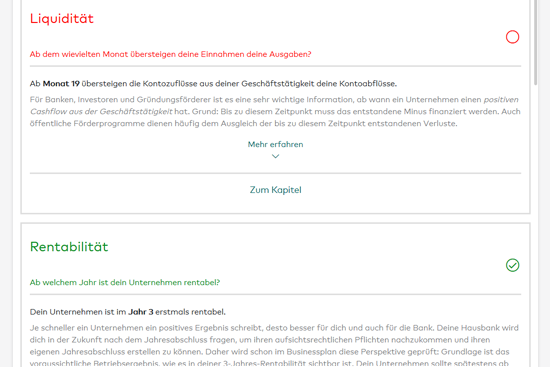

Business plan check

If you have doubts about whether your work will stand up to the critical eye of the bank or the Employment Agency, you can have the key aspects of your business plan checked beforehand. Our built-in business plan check follows a traffic-light system: green indicates that you have done everything right in a particular point, yellow means there is still room for improvement, and red means stop: you’d better take another look at this.

Liquidity, profitability, financing requirements, and equity are the metrics your financial backers will look at first. For this reason, they are automatically reviewed by our check.

The other aspects that our business plan check evaluates relate to the readability and intelligibility of your business plan with regard to visualisation, use of tables and comprehensibility.

Key aspects when writing your business plan

You have now learned about the tools that are available to you on the start-up platform. So we will now take a closer look what makes a good business plan in terms of content.

In your business plan, you describe your business idea from start to finish in a way that enables others to understand the economic viability of it. You set out what you want to sell, where, to whom, at what prices, when your company will be profitable, and how much money you need to tide you over until then.

Many entrepreneurs still think that business plans are written for the bank – but this is a mistake. First and foremost, you write the business plan for yourself. After all, it’s not only your lenders that need to be able to assess the future prospects of your project, but above all you yourself. This is because the biggest risk will always lie with you.

We also know that very few business plans are later implemented exactly how they have been designed as the conditions being worked with change, and we are not able to see into the future. A good business plan does, however, offer you a helpful string to follow, especially in the initial phase, in which its often difficult to maintain an overview. It works like a guide for building your business.

In addition, one aspect often underestimated is that the process of writing your business plan helps you gain a deep understanding of your business. You will recognise the key economic variables and better understand how they are related. This will help you make the right decisions later on.

What does a good business plan need to contain?

1. Executive summary (Zusammenfassung)

The executive summary always features first in the business plan and contains all of the relevant information about your start-up. One page to two pages at most should be enough space to answer the most relevant questions in advance and awaken further interest in the project.

The executive summary is effectively your company pitch, only in written form. In it, you need to set out in a few sentences

- what you are planning

- what is special about it

- why it will work, and

- why you are the right person for the job

In addition, your funding partners of course want to know what exactly you are looking for from them. You therefore need to write clearly what you need, for example using the following sentence: To implement my business idea, I need a loan to the amount of €XY.

Even though the executive summary is at the beginning of your business plan, you should only write it at the end of the process, when you have put your business idea down on paper in full detail.

2. Business idea (Geschäftsidee)

In the second section, you need to describe the core of your business idea, i.e. your product or service, the benefits for the customer, and the key core capabilities for the provision of those benefits.

2.1 Product/service (Angebot)

Specify here the product or service you want to offer to your customers. Emphasise what is new and special about it.

Before you get lost in the details, put yourself in the shoes of your readers and try to determine which points will be interesting from their point of view. This is less likely to be the technical intricacies but rather the commercial potential of your product or service. Also remember that you are not writing for a professional audience. Explain what your product or service is about as simply as possible (this especially applies to technical innovations).

If you have multiple products or services that you want to provide, focus on the most important ones.

2.2 Benefits (Nutzen)

The benefit for your customer should be at the centre of your considerations. Only if you can make it clear that your product or service will improve the lives of your customers (i.e. make them easier, more beautiful, fun, healthier etc.) will your company be able to survive on the market. Your job is to come up with a compelling answer to the question of why people will actually buy your product or service.

Don't forget to mention how you developed this assumption. Have you talked to or observed members of your target audience? Have you shown them a prototype? Or can you perhaps already point to your first customers?

2.3 Core capabilities (Kernfähigkeiten)

Your core capabilities are closely related to the benefit that your product or service provides for the customer because they are the capabilities you need to deliver this benefit. Which core capabilities do you already bring with you, and which do you still need to acquire? How will you go about doing this? For example, will you undertake advanced training or bring people on board whose skills sets perfectly complement your own?

If you are starting up as a team, you will of course need to describe the skills across the whole team.

3. Marketing, distribution and competition (Vertrieb & Wettbewerb)

Marketing and distribution are the key tasks involved in making sure that your product or service reaches your customers. You need to align this sales strategy with the target group and the market.

3.1. Customers (Kunden)

What do you know about the target groups that will buy your product or service? Describe them as precisely as possible. It is also important to look beyond just the characteristics that are directly related to your product or service. Take a wider view and consider where your customers live, how much money they have available, and what stage of life are they in. What habits does this target market have? Where do they get their information? What is important to them? And, above all, what are their purchasing decisions influenced by? You need all of this information to define your sales and communication strategy.

If your first orders are already in sight, your backers will of course be delighted. Elaborate in your text who these clients are and how you acquired them.

Be sure to also describe how you arrived at your findings about your target audience: Did you conduct interviews, analyse statistics, or make observations? Do you perhaps belong to the target group yourself – is solving a problem you have faced yourself the motivation behind your start-up?

3.2 Sales and communication (Vertrieb & Kommunikation)

Typically, companies will rely on multiple sales and communication channels to market their products or services. In your business plan, describe which sales channel you have chosen and why.

The following aspects play a role in the choice of the best sales channels:

- The type of products or services

- The expectations, habits and desires of your target groups

- The strategies used by your competitors

Whether you rely on direct or indirect distribution, sell your products through your own shop or an online shop, or set up an entire franchise system, the main thing is that you are able to justify your decision well. Your planned marketing strategy and customer retention measures should also be covered in this part of your business plan.

Some things seem so self-evident to us that we no longer even think about them. These are likely to include having a website, which is a must. But what functions will your website play in your sales and communications strategy, and how? Similar considerations also need to be made about the exterior design of your shop or restaurant: what will your sign look like? What colour will the facade be? This might all sound banal, but it helps determine whether a passer-by enters your shop or simply passes it by. You should therefore write about these points in your business plan as well.

3.3 Market and competition (Markt & Wettbewerb)

Anyone who starts a company needs to have already studied the market they want to enter in depth.

In your business plan, describe what your market is, how big it is, how it is developing, when saturation would be reached, and what the barriers to entry are. You should also lay out your business goals: do you want to become a market leader or occupy a specific market niche?

You can obtain information for your market analysis from industry reports published by chambers or associations, the Federal Statistical Office, or in trade magazines. Another good means of sourcing information is through conversations with industry professionals.

After this, it’s time to take a closer look at the competition: what are the products that will be competing with yours? Who are your closest competitors, and what do they offer and at what prices? What can you do better than them, and what are they superior to you in?

To avoid getting bogged down in this task, you should limit yourself to about seven companies you will be competing against. You can find the information you need in business directories (e.g. in the Yellow Pages) or on the websites of the individual companies.

If you’re going to be relying on walk-in customers for your business, it's a good idea to do your research locally and simply check out the surrounding businesses that will be competing with you.

Your competitive analysis will form the basis for being able to position your start-up amongst the competition. The better you succeed in setting yourself apart, the easier it will be for you to build a loyal base of repeat customers and stand up against other companies in your target market. Don’t be afraid to turn the existing rules of your industry on their head, but never lose sight of your target audience. Your solution needs to be superior to the other solutions available on the market from their point of view.

4. Team and partners

For many investors and lenders, the person or team starting up a business is more important than the business idea itself. A common saying is that you invest in teams, not ideas. It is therefore essential to include in your business plan a chapter about you, the founder of the business, and your partners.

4.1 Business founders and team (Gründer*in & Team)

Your backers will certainly want to know if you have the necessary skills and competencies to implement your business idea. Are you sufficiently familiar with the sector? Do you have business expertise? And are you up to coping with the stresses of self-employment? It's not just certificates and qualifications that will help to prove you are up to the job but, above all, practical experience.

If you are co-founding your business or are planning to hire staff, these questions obviously apply to the entire team. You need to describe who will do what, and how you will complement each other in your roles.

Be sure to include your motivation for starting a business in this section, and make it clear that you know what you're getting into and that you're up for the challenge.

4.2 Values (Werte)

Every company stands for certain values. These hold the team together and enable it to master change even in difficult times. What values should your company stand for? What is important to you?

4.3 Partners

When we refer to partners here, we mean other companies or self-employed persons whose cooperation you depend on.

Working in partnership brings many advantages: you can share resources, save costs and increase your influence. Many modern approaches to starting up a business, such as Günter Faltin's business based on “components” or the “lean start-up” movement, are rooted in the idea that a start-up will succeed faster, more easily and more flexibly if as many partial services as possible are outsourced, i.e. transferred to partners.

In this chapter, you need to describe which actors you might like to partner with, which tasks you will assign them, and what benefits both sides will gain from the cooperation. If you already have contacts, mention them here.

Suppliers you could change at any time do not count as partners. However, if there is only one company far and wide that can supply you with a central component, then this company is to be considered a partner.

5. Company (Unternehmen)

In the fifth section of your business plan, you need to describe how your company and how production will be organised.

5.1 Production (core activities) (Kernaktivitäten)

Production includes all the steps that are necessary in order for your customers to use your product or service. This not only includes actual manufacturing/service production, but also the procurement of the raw materials, the packaging of the goods, transport, sales and marketing. The steps you cover by yourself can be called your core activities.

Even if you sell something that is non-physical, we still call it production. As a consultant, you “produce” the advice for your clients; as a graphic designer, you produce the layout of a brochure; as a hairdresser, it’s a new haircut.

When outlining your production, you need to get back into the “lean start-up” mindset. Consider and justify which work steps are best handled in-house by your company, and which can be taken on by others. You should also consider how your competitors organise production at their companies. You may be able to set yourself apart from them by coming up with a clever production strategy, and thereby develop a stronger market position.

5.2 Company location (Standort)

Every business start-up has different requirements in terms of the location where it is based. If you want to build an online shop, you need a stable internet connection and warehouses that can be easily accessed by postal and delivery services. A café, on the other hand, relies on a busy neighbourhood and lots of walk-in customers. A freelance graphic designer needs nothing more than their computer and perhaps a desk in a stimulating office community.

In this part of your business plan, demonstrate that you understand what your start-up requires in terms of location and outline how you plan to find the best possible location for it. You need to include not only the geographic location, but also the specific premises where you will operate your company from: how big will they have to be? How will they need to be equipped? And what are the regulatory requirements?

If you already have particular premises in mind for your start-up, describe them in detail (preferably providing pictures and floor plans). In your business plan, also explain what construction work, if any, is still needed, how expensive it will be, and what options it would open up should your company grow and need more space.

5.3 Legal form and regulations (Rechtsform & Vorschriften)

The legal form of your business has implications for tax, ownership, decision-making and-risk sharing in the business, as well as the legal requirements to which your start-up is subject. What licences or permits do you need, and what regulatory requirements do you have to follow when implementing your business idea?

5.4 Risks (Risiken)

Your business plan is not about painting things prettier than they are, but about exploring the opportunities and risks of your business in a realistic manner. By setting out the biggest threats to your start-up and outlining your strategies to counter them, you will prove that you have dealt with all relevant aspects in full and are not naive.

The following is a list of typical risks that can cause start-ups to fail:

- Attracting clients is more difficult than expected because the target group does not recognise the benefit provided by your product or service

- Customers are not willing to pay the price asked

- The competition is stronger than expected

- Suppliers suddenly fail you

- Customers do not pay your invoices, or make you wait

Sometimes the general conditions of an entire industry can change so dramatically and quickly that there is hardly any time to adjust. How flexible could your business be in responding to a situation like this?

In your business plan, describe some typical worst-case scenarios and how you will prepare for them.

6. Finances (Finanzen)

Having a coherent financial plan is the be-all and end-all when starting a business. Your financing partners will want to know exactly what investments are needed, where the money will come from, and how good the prospects are that your business will be commercially viable in the long term.

6.1 Sources of revenue/sales (Ertragsquellen/Umsatz)

In this section, you need to describe what your company does to make money and how revenue will develop over the course of the first three years. How many units do you plan to sell in the first month? How many in the second, and how many in the 18th? The financial plan wizards on the start-up platform will help you to calculate this.

When a business launches, sales are normally pretty small but increase over time. You can choose whether to present your sales development as a linear increase or a step-wise movement. You can then manually adjust your actual sales results if your business is subject to seasonal fluctuations, which is very often the case.

Remember: your sales development data should not be based on wishful thinking, but on well-founded assumptions. For example, if you open an online shop, you need to be able to justify why you will only have ten orders a week at the beginning, and over a hundred a day six months later.

When developing your financial plan, however, it is not only relevant how much money you will receive for the sale of your products or services, but also when and how the money will come in, i.e. whether your customers will pay in advance, purchase your products by subscription, or have a payment period of 30 days.

There is also space in this section to set out your pricing. What assumptions are your chosen prices based on, and how do they compare to the competition? There are good reasons why you might set your prices well above or even below market prices – don’t forget to mention these in your business plan.

6.2 Costs (Kosten)

The counterweight to your sales is the costs. These include everything you spend money on in your business. Their total amount gives you a guide as to how high your sales need to be in the long run if you don't want to end up bankrupt.

Unlike sales, expenses can be planned quite well in advance. If you conscientiously record all of the items to be purchased and ascertain their respective prices, you are more likely to avoid any unpleasant surprises.

The business plan distinguishes between following types of costs:

a) Variable costs are dependent on sales: the more you sell, the higher these are. This type of cost mainly includes expenses for the purchase of goods, raw materials, packaging or logistics.

In the start-up platform’s business plan tool, variable costs are recorded via the Direct costs financial wizard. Here you can specify which sales items are associated with which charges and view the cost trend for each item individually.

b) Fixed costs are always incurred, even if you don't sell anything at all in a given month. Typical fixed costs might be personnel costs and rents.

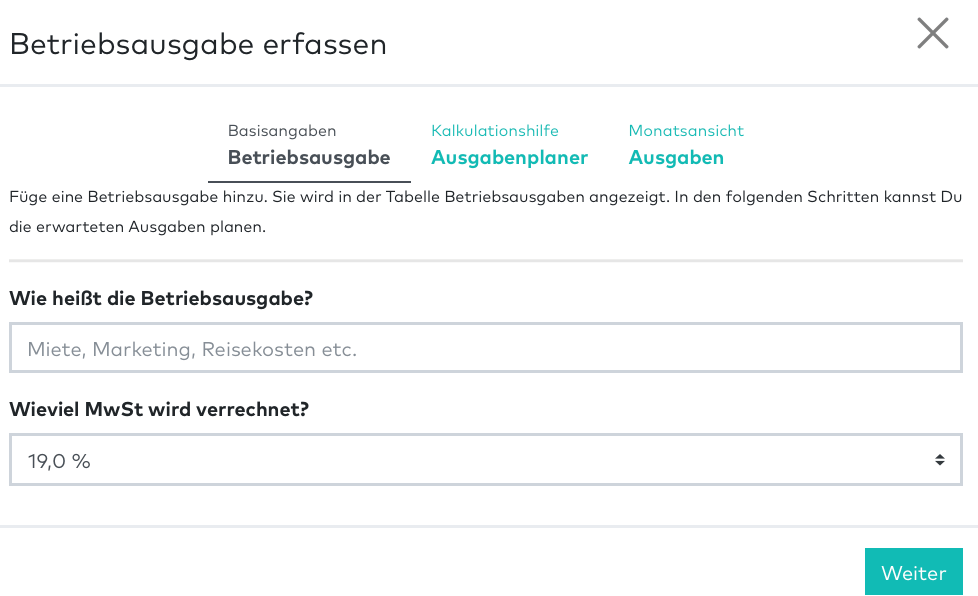

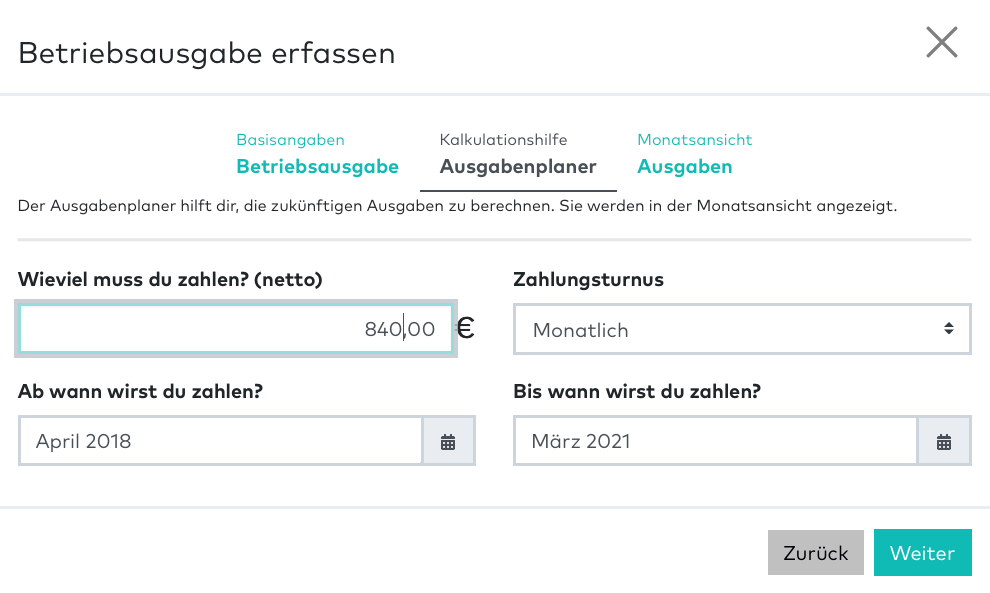

Costs in this category are recorded on the start-up platform using the Operating expenses (Betriebsausgaben) wizard.

You can calculate your fixed costs by using the wizard for recording your operating expenses.

If you can increase your variable costs while also reducing your fixed costs, you will reduce your overall business risk. At the same time, your profit margin per unit sold will become smaller.

6.3 Private expenses (Privat)

Your private expenses are also crucial for your business plan because your business not only needs to be able to support itself, but also to provide for you. How much would your income have to be to cover all of the living expenses for yourself and your family?

Your salary should be realistic and neither too high nor too low. If it's too high, your funding partners will rightly wonder if they want to fund your life of luxury. If it is too low, they will have to assume that sooner or later, you will run into personal financial difficulties.

Using our withdrawal planner, you can track all your personal expenses – from spending on groceries, to your annual long-distance trip, to health insurance. Don't forget to also deduct the income tax you will have to pay on your personal withdrawals or salary.

You need to compare your private expenses with your private income. For example, if you are also in part-time employment, you need to enter your income from non-self-employment here. Rental income or child support payments for your children should also be recorded here.

Anyone wishing to use their business plan to apply for a start-up grant should note that this subsidy does not count towards company revenues, but is recorded as private income. It is best to find out in advance from the Employment Agency whether or not you should include the start-up grant in your business plan.

Note: only in the case that a partnership is being formed is the founder's salary recorded as a private withdrawal. In the case of corporations (GmbH, AG, UG), it is instead budgeted as a managing director's salary under personnel expenses.

6.4 Capital requirements and financing (Kapitalbedarf & Finanzierung)

In this section of your financial plan, it’s about calculating how much money you need to start your business, and it’s important that you set out where these funds will come from.

Your capital requirements (Kapitalbedarf) are made up of your

- investments

- costs of starting up the business

- required liquidity reserve

- the money you need to see you through the start-up phase

This is offset by your equity capital and any contributions in kind (for example, machines, computers or vehicles that you contribute to your company). Financing will be needed to make up the difference.

When planning your financing, you can use the start-up platform wizard to record each cash deposit, each loan and each overdraft facility separately. These are automatically summarised in the Financing overview for the first three years after your start-up is launched.

The usual way to finance a new business in Germany is through applying for bank loans. In addition, there are a number of government-run programmes that provide certain subsidies to start-ups. Information on these can be obtained from Kreditanstalt für Wiederaufbau (KfW) or from your local bank.

6.5 Profitability (Rentabilität)

Profitability is considered one of the most meaningful indicators of a company's success. It is derived by comparing anticipated expenses with expected revenue, and indicates what remains of this revenue after deducting all expenses.

When you create your financial plan on the start-up platform, the profitability of your business is automatically calculated based on the information you have already entered for the first three years of business.

Although it would be desirable to be turning a profit as early as possible, this isn’t so easy. After all, you first need to master market entry and will need to make considerable investments before you get there. Your funding partners know this, too, and are generally forgiving of negative profitability in the first year or two – provided that there is an upward trend and the point at which you will break even is foreseeable.

The journey from minus figures to plus is typically marked by several milestones that you should mention in your business plan. Your funding partners will appreciate it if you are able to tell them

- when you will first make an operating profit (i.e., before deducting imputed costs such as depreciation)

- when your business will be able to generate enough to cover write-offs (after all, you will have to replace your machines or computers one day)

- when it will yield enough profit to cover your private living expenses and make debt service payments (interest plus repayment)

6.6 Liquidity (Liquidität)

In your liquidity planning, you will calculate whether you have enough money in your account at any given time to meet your payment obligations. Another word for liquidity is solvency.

Having a lack of liquidity is one of the most common causes of insolvency. If you are unable to pay your bills, reorder goods, or pay your staff, it doesn't make a difference even if there are lavish profits just around the corner. Liquidity planning is therefore almost more important than profitability forecasting, and should be done with the utmost care.

Your ability to pay stands and falls with your sales planning (see above). If your sales do not develop nearly as positively as predicted, your liquidity will collapse quickly too.

A typical source of error when it comes to calculating liquidity is taxes. Many new entrepreneurs consider unpaid VAT, for example, as a liquidity reserve. Make sure you don't do that. Just because it’s in your account, it doesn’t mean that the money is yours! And the tax office doesn't have much patience with those who get behind with their tax payments.

7. Appendix (Anhang)

The appendix should contain all of the documents that support the information you have supplied in your business plan and provide further details about your business idea. All the data and calculations that your reader needs in order to understand your business need to be presented in the main section.

The appendix should contain the following:

- Curriculum vitae in tabular form (max. 2 pages)

- References (in so far as they are relevant for the start-up project)

- Qualifications and other certificates

- Patents

- Product descriptions/data sheets

- Contracts, draft contracts, cooperation agreements

- In the case of planned (re)construction measures: land register entries, plans, cost estimates

- Evidence of equity (bank or custodial account statements, private loans)

- Certificates of approval (operating permits, concessions)

Our start-up platform has been rated by more than 8.000 people with

out of 5 stars. You can rate us too!