Welcome to Equity Control

Equity Control is a tool for startups and investors. Features include Cap table management, waterfall analysis, scenario modelling and more. If you have not yet registered, start now with your completely free Cap Table Management

With Equity Control you can:

- Digitally manage your Cap Table

- Analyze Liquidation Preferences

- Modeling scenarios for financing rounds

- Managing ESOP and Vesting

With this guide you will learn how to get the most out of the platform for your company.

Quick Start: Company Investment

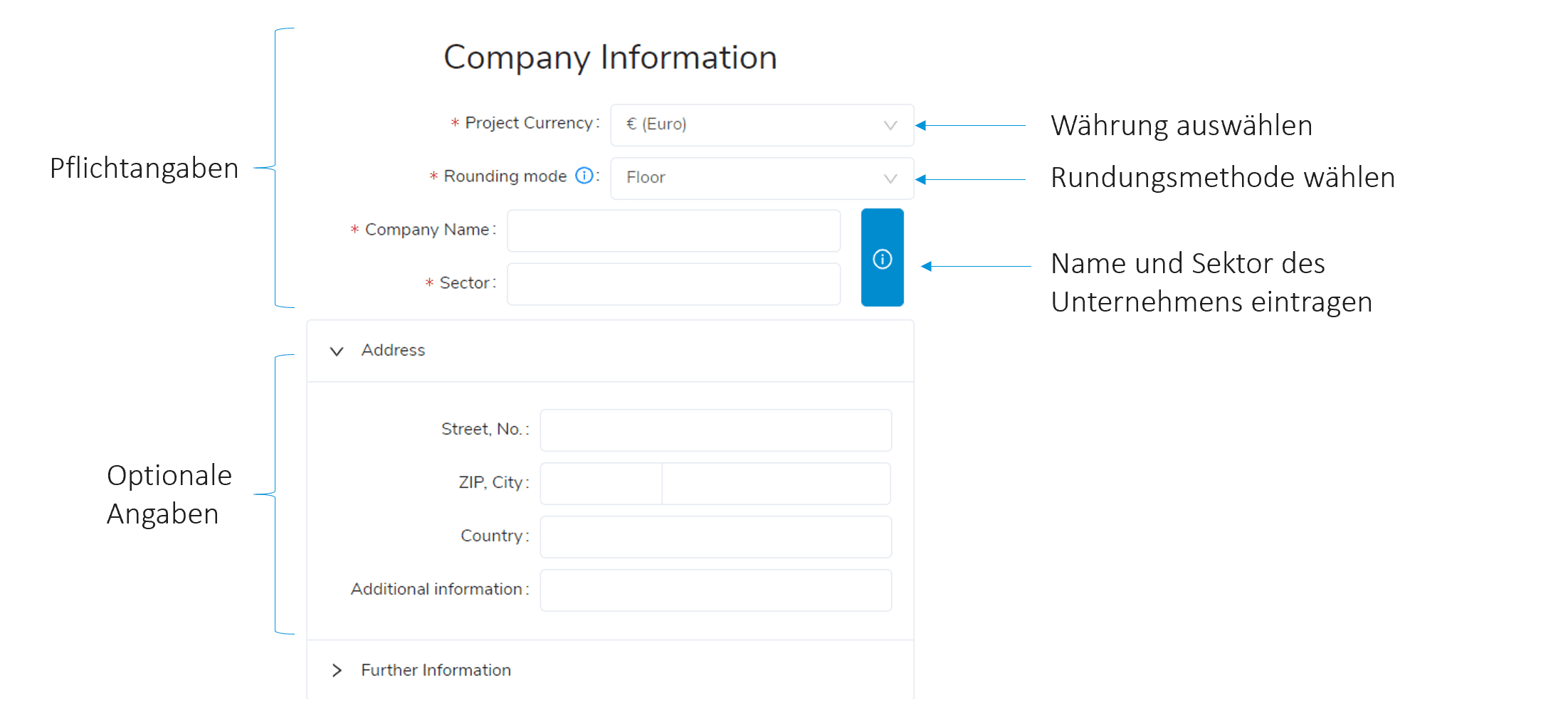

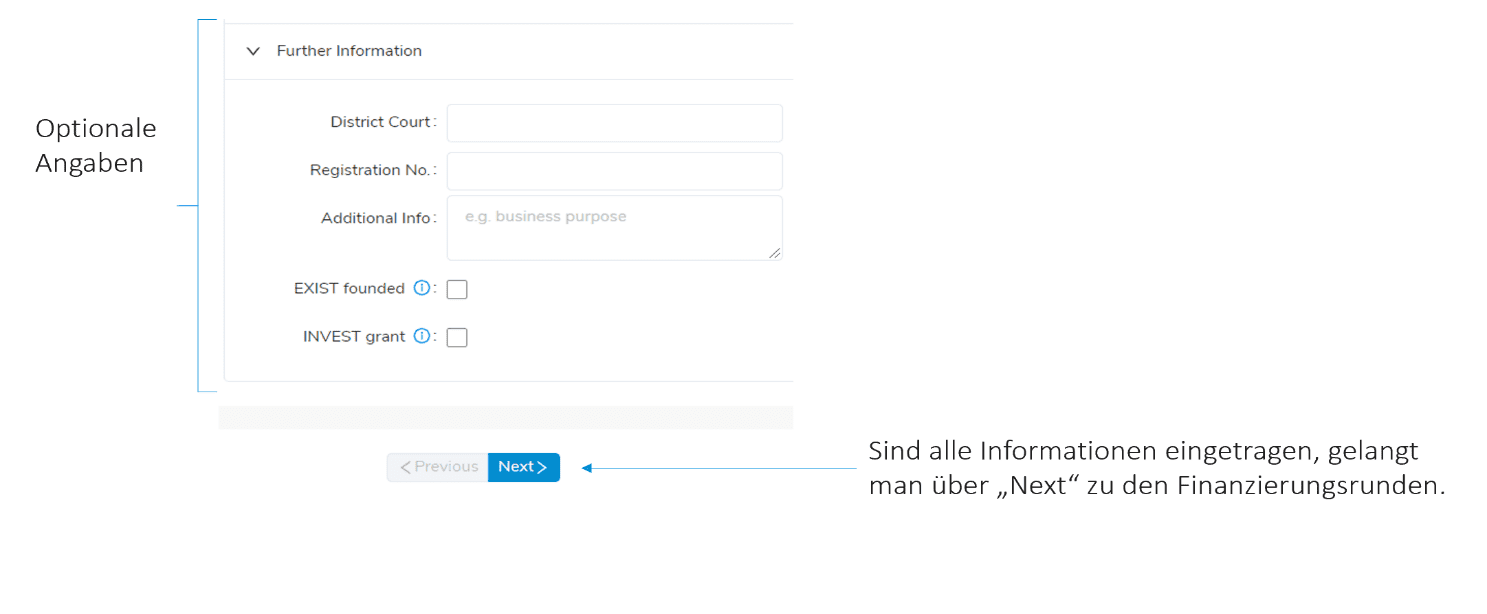

The creation of the initial data is carried out by means of a step-by-step guide and is divided into mandatory data and further optional data

At the beginning, select the desired currency as well as the rounding rules to be applied in the calculations.

You can choose from rounding up, rounding down or mathematical rounding.

Quick Start: Initial setup of the cap table

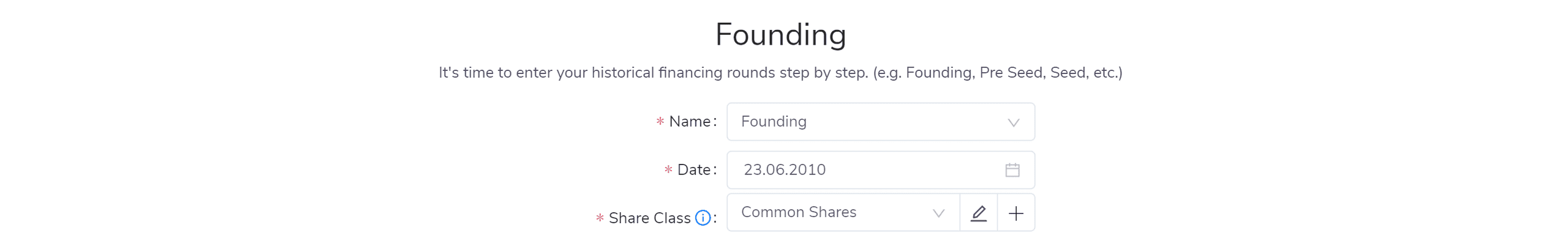

The creation of the cap table takes place over several sequences. First the initial foundation structure is entered.

For this purpose the preset foundation can be selected in the dropdown. Thus no valuation of the company has to be entered and the share price is set directly to 1€. Likewise, shares are directly selected in the Share Class.

Quick Start: Set-Up Video

In this video you can see with the help of a short demo, how you collect your Cap Table data with the help of our Onboarding Tour.

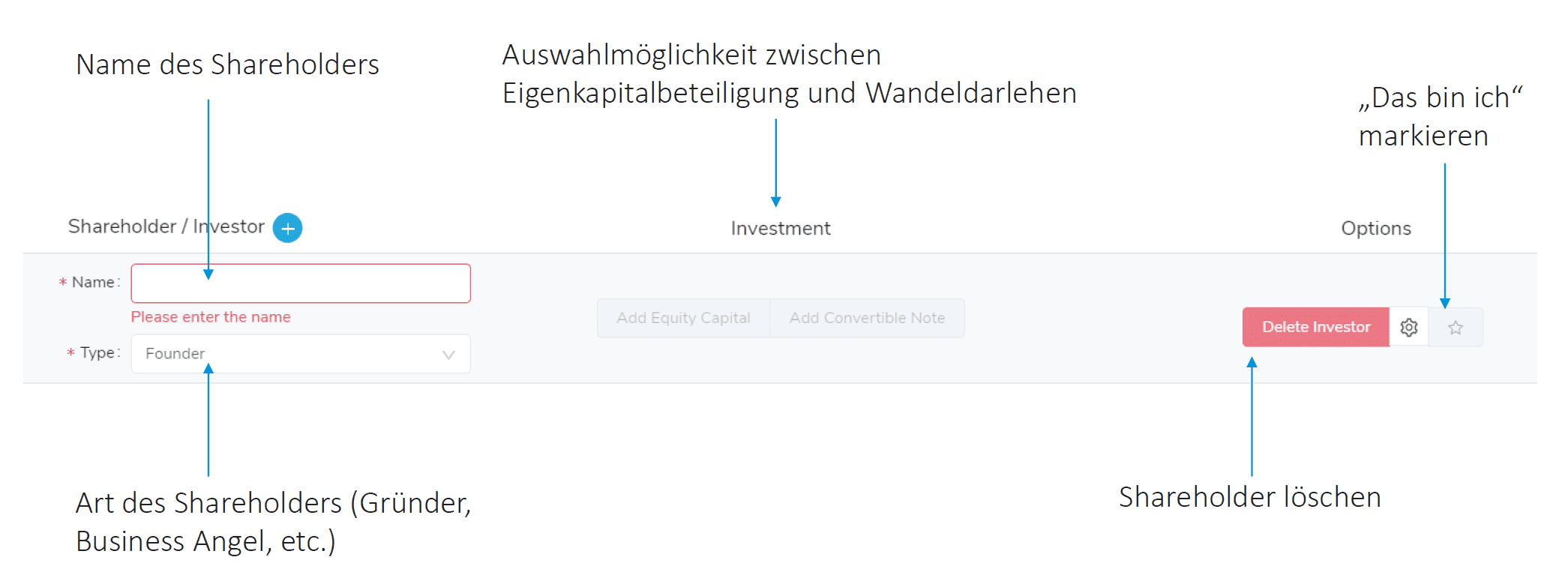

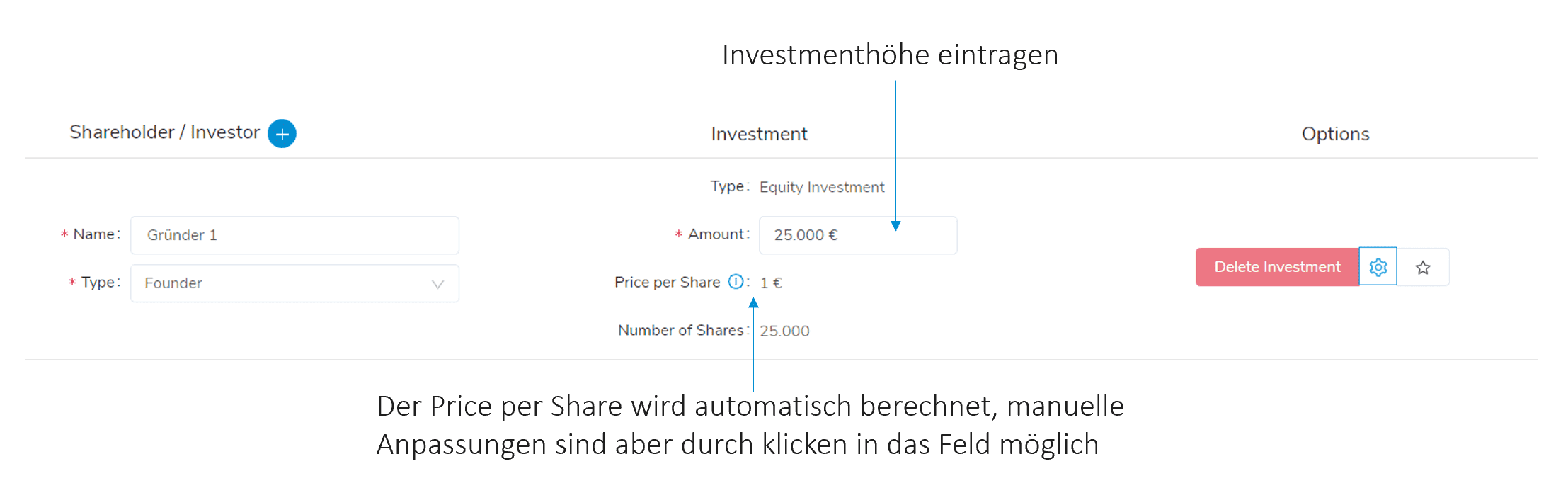

If all data is valid, the next step is to create the founding partners.

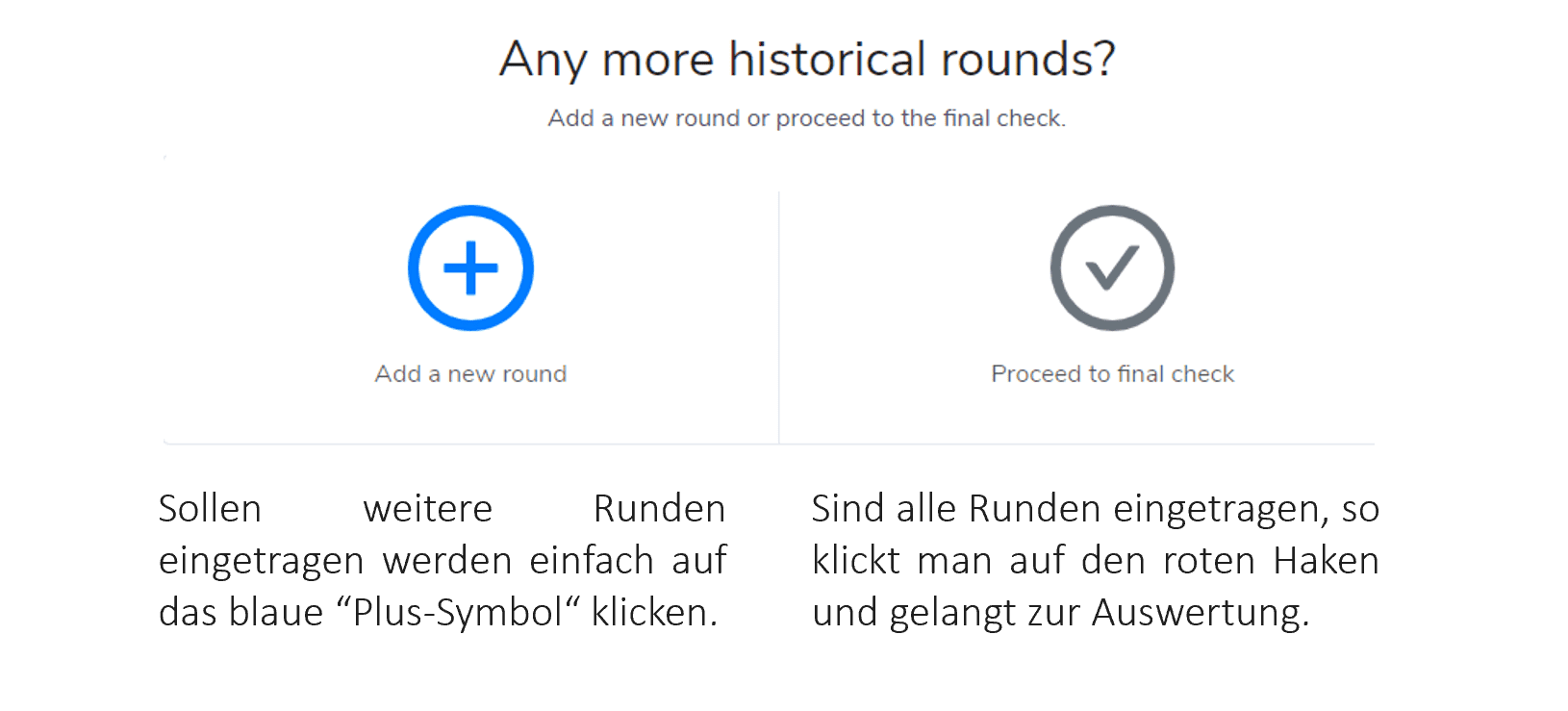

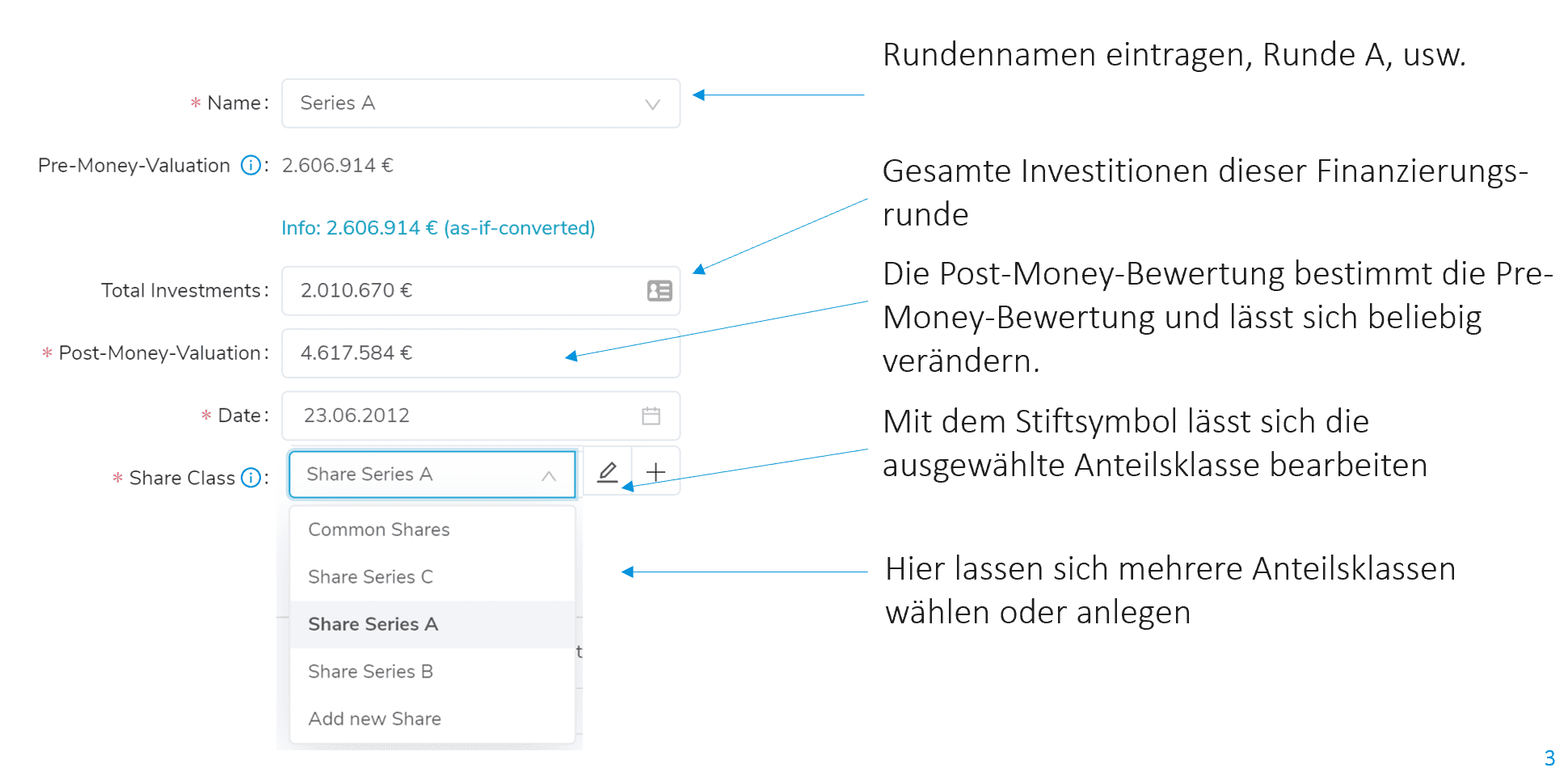

Create additional historical financing rounds

The correct recording of the corporate structure is important for the economically correct calculation of waterfall analyses and financing round models. For this reason, the individual historical financing rounds are entered within the recording.

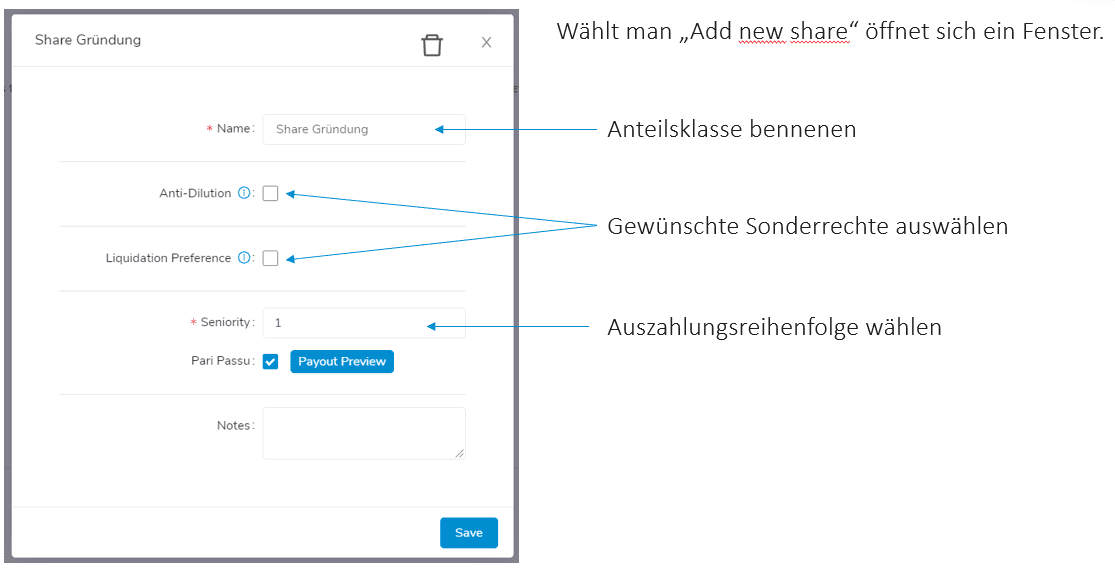

If a new lap is entered, the already familiar input mask appears, with further selection options.

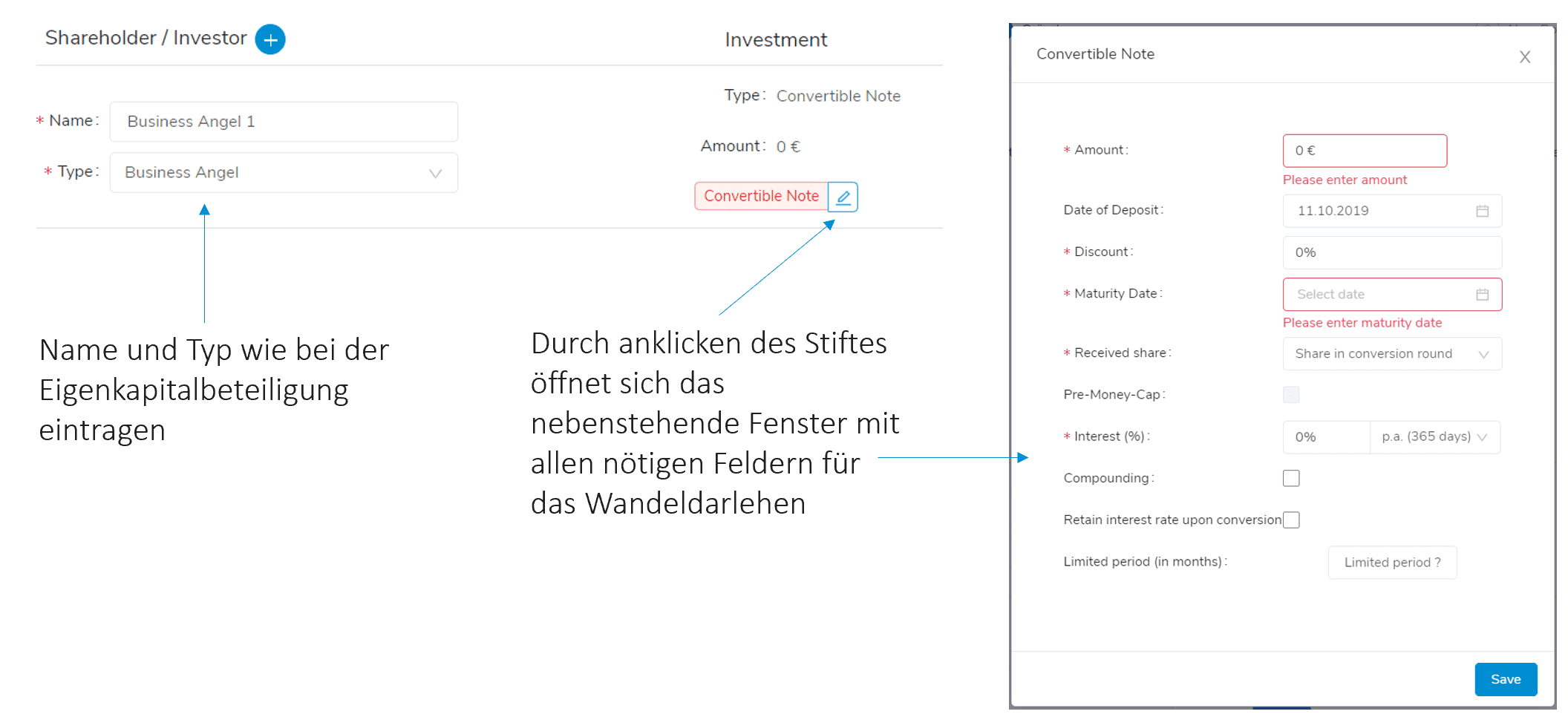

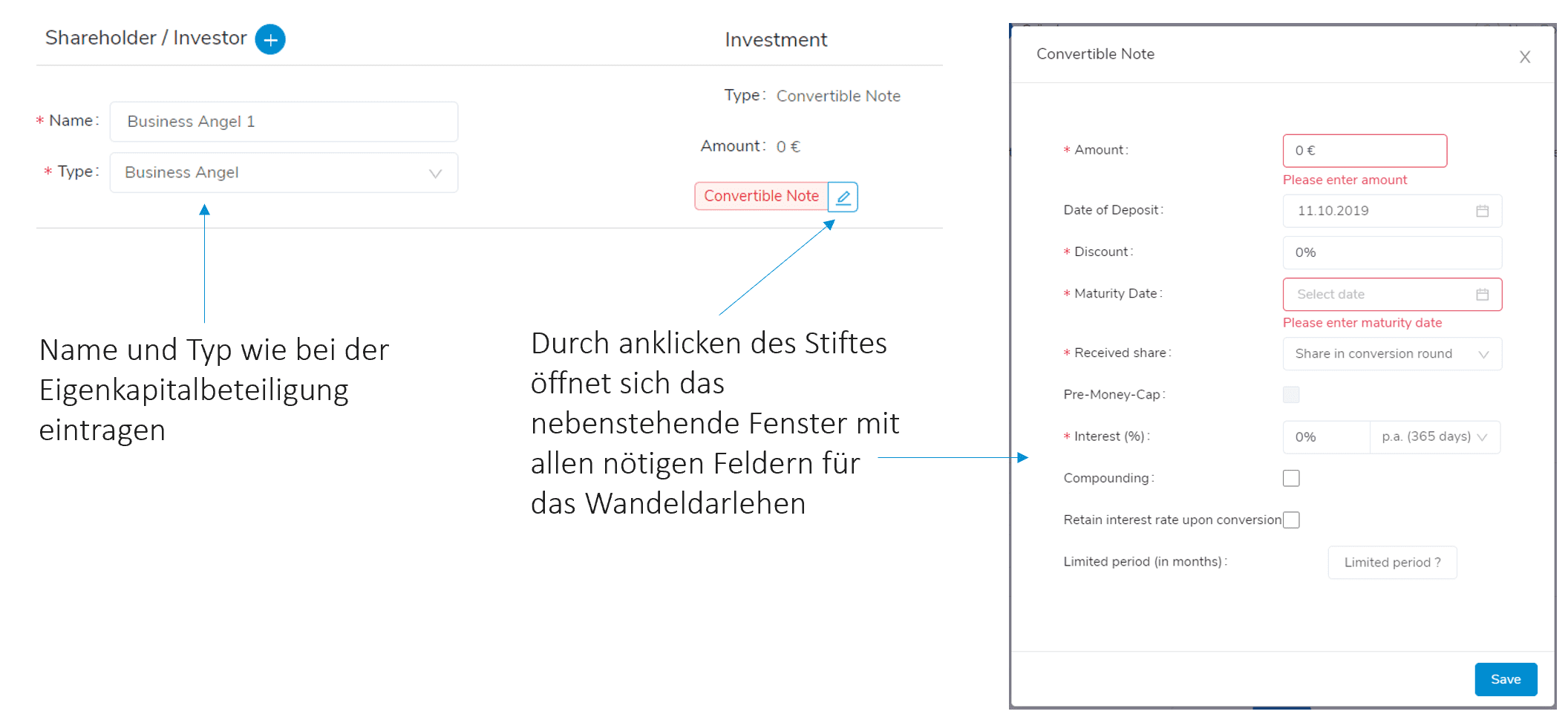

Coverage of convertible loans

If a funding is represented purely by convertible loans, the round name can be set to Convertible Note only using the drop-down menu. All parameters, such as valuation etc. disappear in this case

The shareholders are created as before, only that a convertible note is selected instead of an equity investment.

By clicking on the red pencil, the convertible note can be edited.

Note:

If a convertible loan is brought in within a financing round and fully converted in the same course, it must be made in a separate round. Only in this way are the corresponding "as-if-converted" calculations correct.

Alternatively, each share price can also be adjusted manually.

In most cases, the conversion of the loan is done in the next round. If you are currently planning a round, use the modeling tool.

If you have created another financing round in which a conversion has been made, the software will tell you that you can add a conversion.

Coverage of secondary

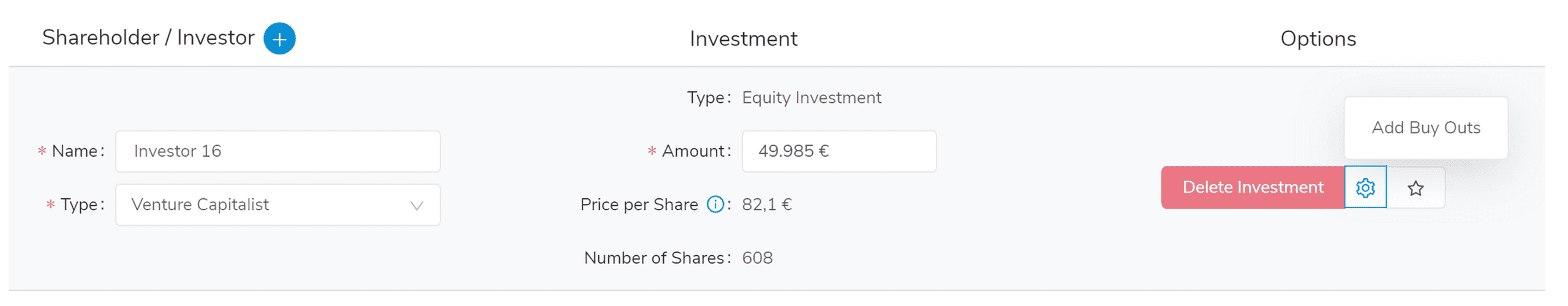

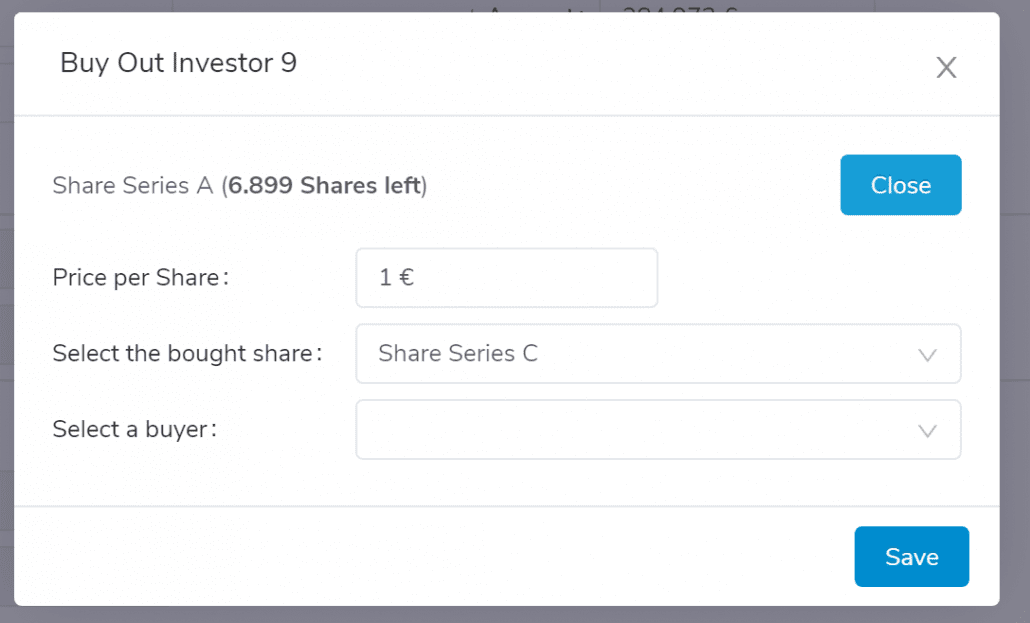

It is also possible to add a partial sale of shares or a complete secondary exit. First create the new shareholder who receives the shares and then scroll to the investor whose shares are to be sold.

Via the options icon you can add a buy out / secondary. Select the price paid, the share class to be sold and the previously created buyer.

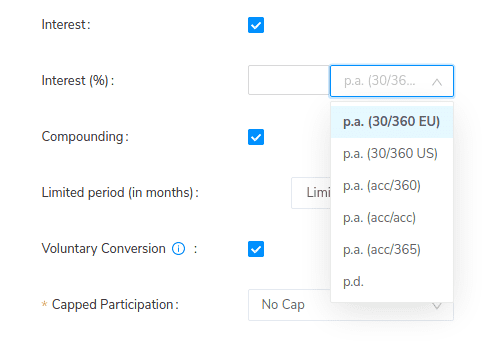

Interest rate regulations

Within the software you can choose between the different methods for convertible loans or interest-bearing liquidation preferences, among other things. Deviations in the interest calculations can result either from the selection of the wrong method or from different ways of counting days. The calculations for compound interest are based on the concept of mixed interest. The current year is subject to linear interest, full years to exponential interest and the last year or part of a year to linear interest.

act/360 - Euro Interest Method

- The interest days are determined by calendar, so the interest year has 365 or 366 days (leap year)

- The base year is set at 360 days, regardless of the number of actual days.

- With the Euro interest method, interest is paid on the first investment day, but no interest is paid on the last investment day.

act/365 - english interest method

- The interest days are determined by calendar, so the interest year has 365 or 366 days (leap year)

- The base year is set at 365 days.

- Interest is not calculated on the first investment day, interest is calculated on the last investment day.

act/act - to the day

- Interest days are determined by calendar. So the interest year has 365 or 366 days (leap year).

- The base year is defined like the interest year.

- The first investment day does not earn interest, the last investment day does.

30/360 - german interest method / US method

- The interest month is always 30 days, the interest year is always 360 days

- The base year is set at 360 days.

- In the US method, February is set at 28 or 29 days to the exact calendar date, provided that the start or end of the period falls on one of these days.

In most cases, you can find the agreed interest method in your investment contracts.

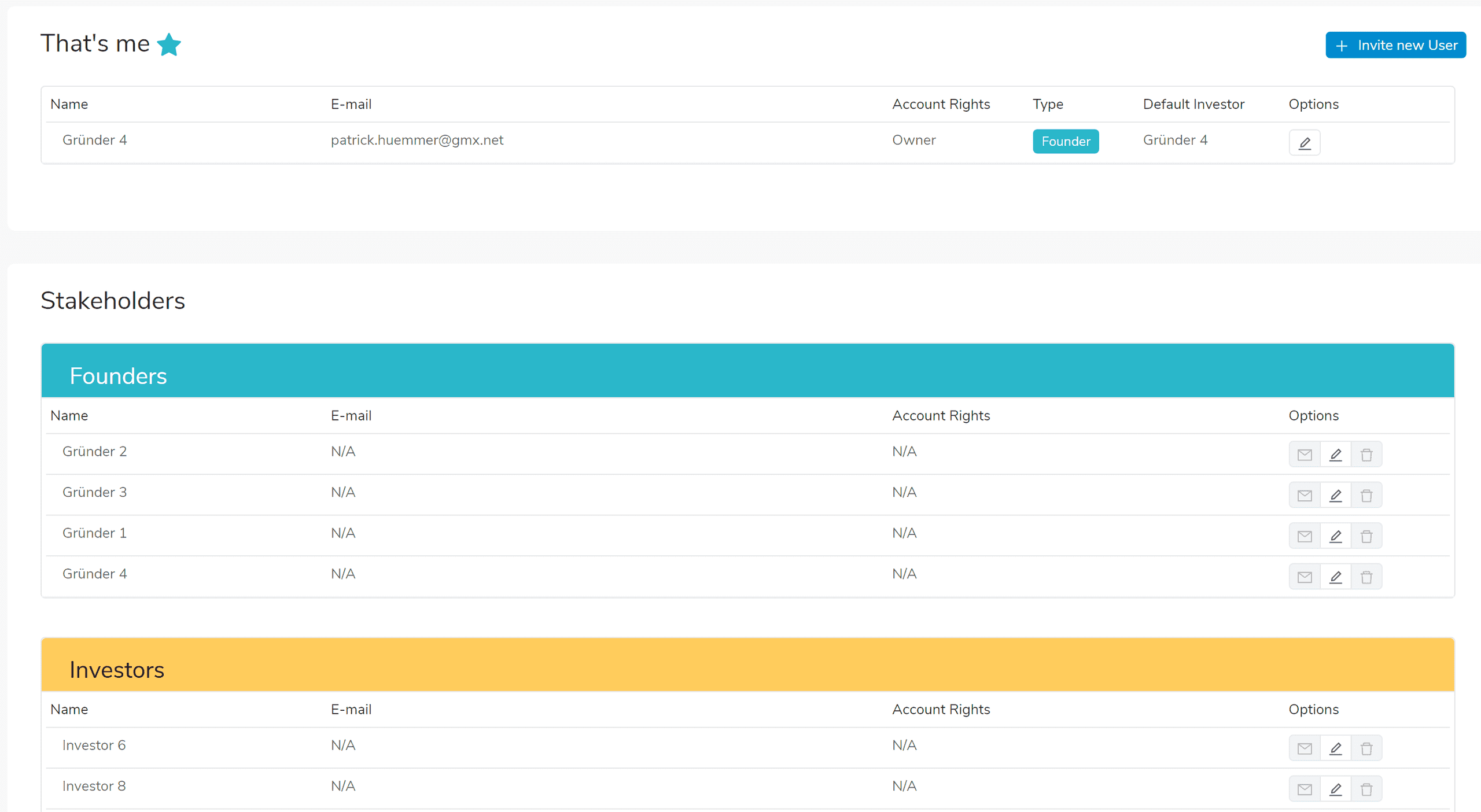

Invite co-founders and other stakeholders

You have two options for inviting other stakeholders to your cap table. The procedure is identical in both cases.

- Directly after entry via the tour

- Within the stakeholder page

On the stakeholder page all created shareholders, as well as the users you invited are managed. You can create new users via the invite button by entering their email address, or invite existing shareholders by adding an email address and clicking on the mail icon

With different access rights you keep control over who can access which pages. You can deactivate access at any time with the delete icon, and change the access rights with the edit function

You can also change the access rights with the edit function

However, only the initial creator of the project can obtain the "owner" status.

Account Management

Versions and Payment

This article will help you compare our different versions.

Our pricing is based on the type of version and the volume of financing for the invested (portfolio) company.

DSGVO

Equity Control has implemented processes and procedures to ensure that we meet our obligations under the General Data Protection Ordinance (DSGVO)

It is important to note DSGVO does not have an accredited certification method, which means that there is no GDPR approved way to prove compliance. If you have any questions regarding data protection, please contact [email protected]

Security

Equity Control has stringent privacy controls, including encryption of data to protect the data subject's information from inadvertent disclosure or misuse

Equity Control adheres to industry best practices for information security and tests its products to proactively remediate errors and vulnerabilities

Equity Control has data recovery and data integrity procedures in place to ensure that customer data is not lost or inadvertently damaged

Equity Control ensures that the customer retains complete control over their data.

Equity Controls key data subprocessors, such as Google Cloud Services, adhere to all strict security standards (SOC2 and/or ISO 27001 certifications where possible)

If you or your company would like your data to be completely removed from our systems, please send an email to [email protected]

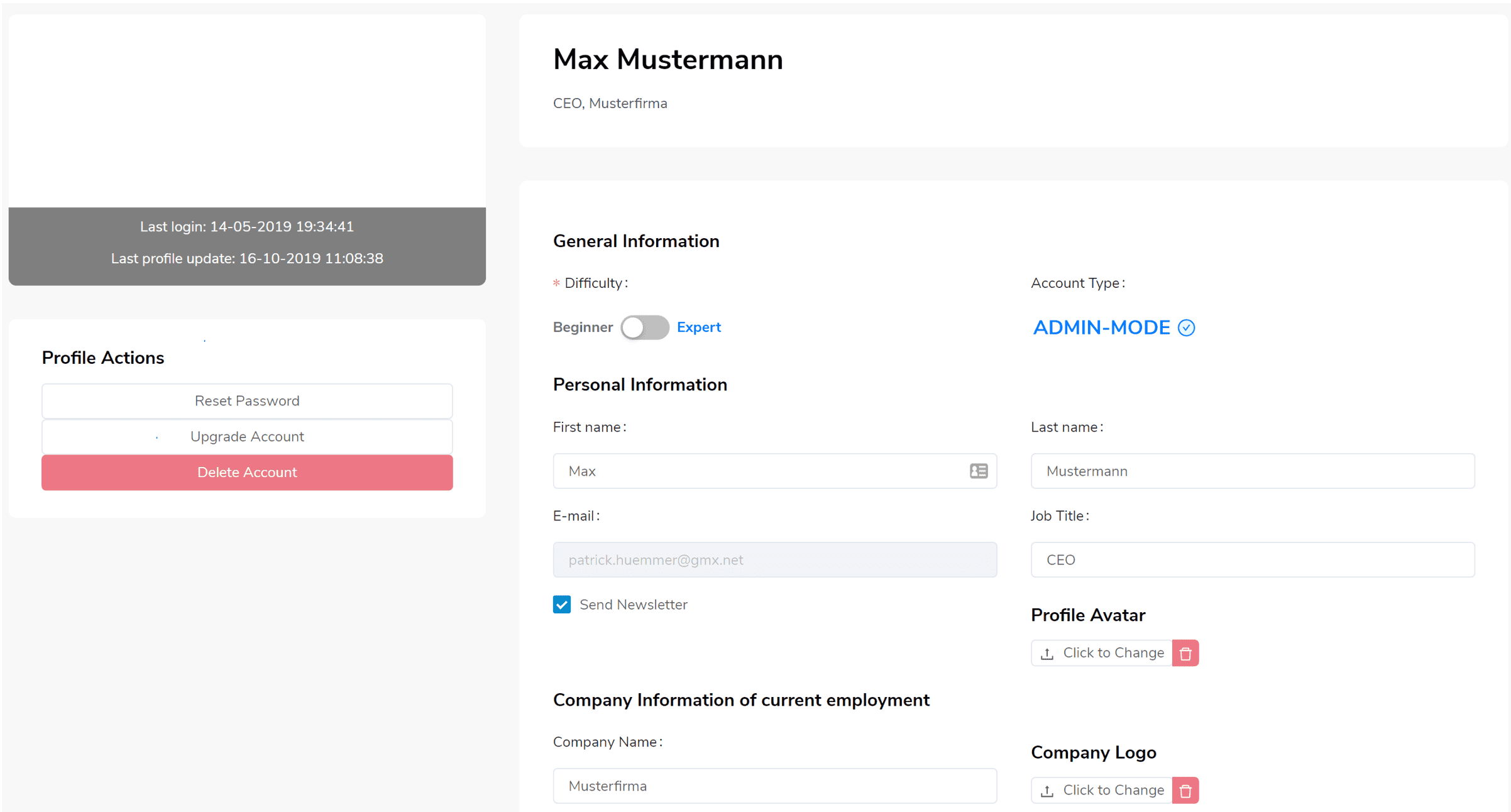

Change Password

You can reset your password in your user account settings.

To do so, click on the profile icon within the software, which is located in the upper right corner.

Click on Reset Password and confirm. You will then receive an automatic e-mail with a link to reset the password.

Click on the profile icon within the software, which is located in the upper right corner.